cayman islands tax residency certificate

The Cayman Tax Information Authority can grant tax residency certificates to individuals ordinarily resident in the Cayman Islands. It is responsible for administering all of the Cayman Islands legal.

Cayman Islands Residency Check Your Eligibility Today

The income and investment figures are lower if the applicant intends to reside in Cayman Brac or Little Cayman where an applicant must be able to demonstrate a continuous source of annual.

. To apply for a Residency Certificate Persons of Independent Means visa you must provide evidence of a regular source of income of 150000 USD or more annually maintain a bank. In particular one can apply to the Director of. Last reviewed - 04 August 2022.

Fees are payable At the time of submitting an application 1000. Therefore corporate residency is also not relevant in this regard. The fee to make an application for a Residency Certificate for Persons of Independent Means is CI500 US60975 and if the application is approved there is an issue fee of CI20000.

In the DTAs entered into between Hong Kong and its treaty partners a Hong Kong resident company is defined as-. For foreign nationals not wishing to work in the Cayman Islands but simply wishing to have the right to reside there are alternative options. When you will out your application for your Cayman Islands Residency Certificate you will pay a 1220 application fee as well as a 6100 activation fee for your residence permit.

The Department for International Tax Cooperation is a department in the Ministry of Financial Services and Commerce. The surviving or former spouse may within a period of three months of any revocation apply for the grant of a Residency Certificate for Persons of Independent Means in their own right. Tax residency requirements under Hong Kongs DTAs.

Corporate - Corporate residence. ² A Residency Certificate Substantial Business Presence may be varied to add or remove dependants. Residency is available by acquiring a Certificate of Direct Investor for those persons who have made or propose to make an investment of at least 1000000 KYD 1220000 USD in a.

Certificate of Direct Investment. There are no corporate income capital gains or other direct taxes imposed on corporations in Cayman Islands. Individuals with a demonstrable track record who invest a minimum of 1 million in a licensed employment-generating business in the Cayman Islands.

When you will out your application for your Cayman Islands Residency Certificate you will pay a 1220 application fee as well as a 6100 activation fee for your residence permit. The Cayman Islands residency programme is suitable for highly successful investors and entrepreneurs who live very international lives. Any person who has been legally and ordinarily resident in the Cayman Islands for at least eight years but not more than nine years other than the holder of a.

Since no corporate income capital gains payroll or other direct taxes are currently imposed on corporations in the Cayman Islands corporate residency is not. A Residency Certificate Substantial Business Presence is available to individuals who either own at least a 10 share in an approved category of business or will be employed in a senior. A Certificate of Permanent Residence for Persons of Independent Means may be granted to persons who invest at least two million Cayman Islands Dollars in developed real estate.

Company Registration In The Cayman Islands Business Starting Setup Offshore Zones Gsl

Residency In The Cayman Islands

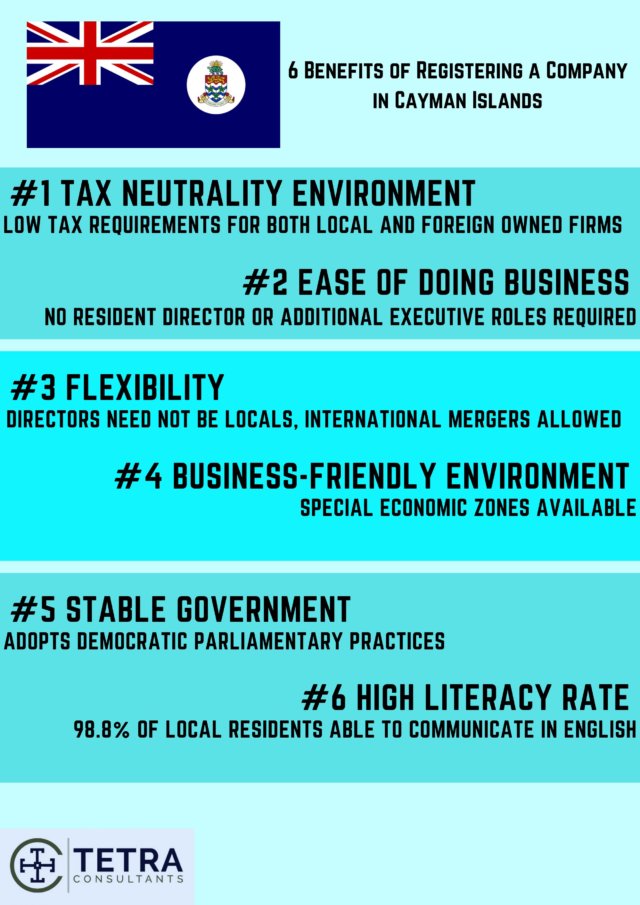

6 Benefits Of Registering A Company In Cayman Islands

Apostille For Cayman Islands Cayman Islands Apostille Dc Apostille

Rerc Cayman Fill Online Printable Fillable Blank Pdffiller

A Guide To The Benefits Of Cayman Islands Residency Investment Migration Insider

Tax Residency Certificate Requirements Kpmg Global

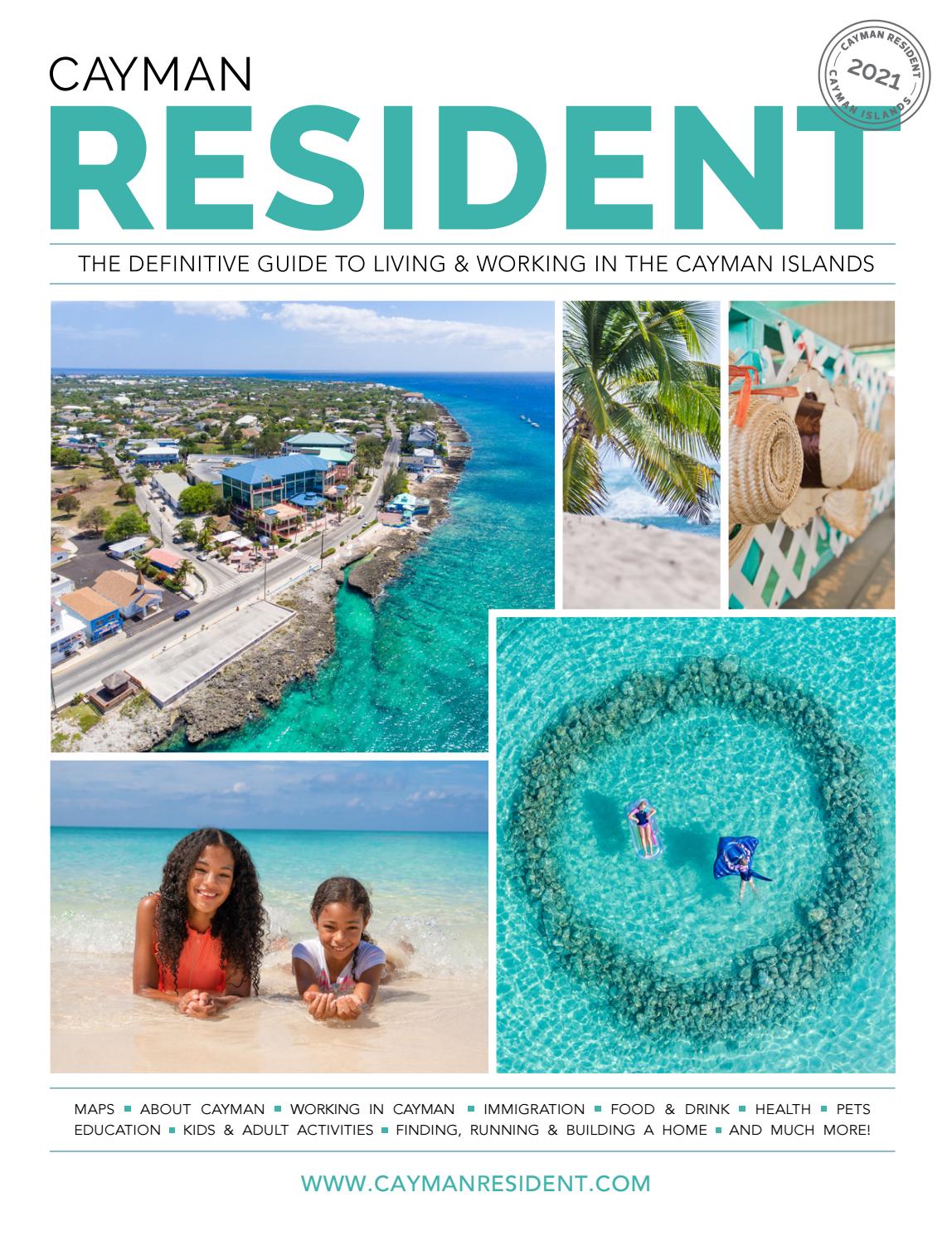

Cayman Resident 2021 By Acorn Media Issuu

The Cayman Islands Offer Retirees More Than A Tax Haven Mansion Global

Lifestyle Lacovia Cayman Islands

The Cayman Islands Residency By Investment Programme Latitude

The Cayman Islands Digital Nomad Visa Global Citizens Concierge

Registration And Tax Questionnaire Guidance Alphabet Google Suppliers Help

Cayman Islands Launches Program For Long Term Guests Travel Agent Central

Cayman Islands Fatca And Common Reporting Standard Deadlines

Cayman Residency By Investment Guide Provenance Properties

Fillable Online Certificate Of Permanent Residence For Persons Of Independent Means Fax Email Print Pdffiller

Registration And Tax Questionnaire Guidance Alphabet Google Suppliers Help

Tax Residency In Low Tax Jurisdictions To Legally Reduce Taxes Flag Theory